IRS FinCEN 109 2011-2026 free printable template

Show details

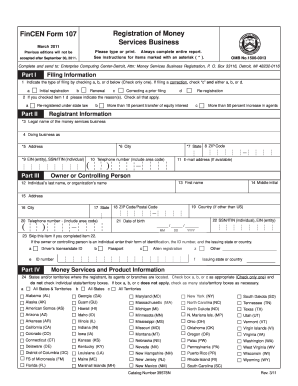

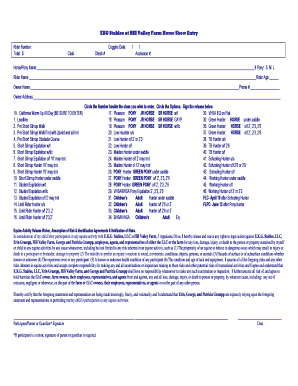

Fin CEN form Suspicious Activity Report by Money Services Business 109 March 2011 Previous editions will not be accepted after September 2011 1 Please type or print. Always complete entire report.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign sar form

Edit your irs suspicious form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sar filing form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs form 109 online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sars form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS FinCEN 109 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out south carolina minor change form

How to fill out IRS FinCEN 109

01

Obtain the IRS FinCEN Form 109 from the IRS website or your tax preparer.

02

Fill in your personal information such as name, address, and taxpayer identification number.

03

Indicate the type of transaction being reported in the appropriate section.

04

Provide detailed information about the account involved, including account number and financial institution details.

05

Report the amounts related to the transaction accurately.

06

Double-check all entries for accuracy.

07

Sign and date the form where required.

08

Submit the completed form to the appropriate address as specified in the instructions.

Who needs IRS FinCEN 109?

01

Individuals or entities that have engaged in certain financial transactions involving foreign accounts.

02

U.S. citizens and residents with foreign bank accounts exceeding specified thresholds.

03

Businesses reporting foreign bank accounts or financial interests.

Fill

sar template

: Try Risk Free

People Also Ask about fincen sar form pdf

Can you paper file FinCEN 114?

The Report of Foreign Bank and Financial Accounts (114) must be filed electronically using the BSA E-Filing System.

Can I file my own FBAR?

To file the FBAR as an individual, you must personally and/or jointly own a reportable foreign financial account that requires the filing of an FBAR (FinCEN Report 114) for the reportable year. There is no need to register to file the FBAR as an individual.

How is FinCEN form 114 required to be filed?

The BSA requires a USP to file FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR) for each calendar year during which the aggregate amount(s) in the foreign account(s) exceeded $10,000, valued in United States (U.S.) dollars, at any time during the calendar year.

How can I download the FBAR form?

The relevant financial forms (1040, 2555, etc.) can be downloaded directly from the IRS website. The FBAR must be filed electronically via FinCEN Form 114 on the BSA e-filing system.

How hard is it to file a FBAR?

It must be submitted separately to the Department of the Treasury, not the IRS. To file the FBAR, you'll use FinCEN 114 and submit it electronically through the BSA e-filing site. The process is straightforward and requires you to gather all pertinent account information and enter it into the online system.

Fill out your IRS FinCEN 109 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Is A Fincen Form is not the form you're looking for?Search for another form here.

Keywords relevant to sar report form

Related to sar form pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.